nh food sales tax

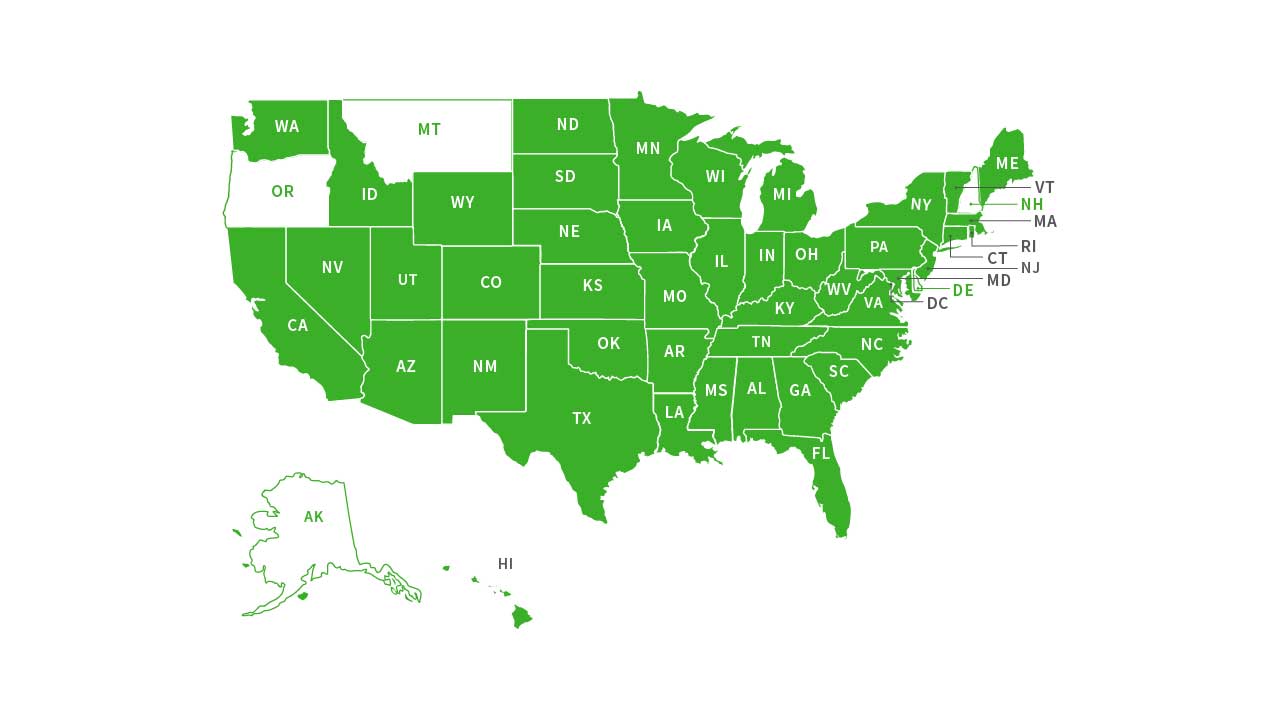

New Hampshire is one of the few states with no statewide sales tax. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown.

New Hampshire Sales Tax Rate 2022

The Portsmouth New Hampshire sales tax is NA the same as the New Hampshire state sales tax.

. Start managing your sales tax today. Additional details on opening forms can be found here. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Hampshire local counties cities and special taxation districts.

A 9 tax is also assessed on motor vehicle rentals. The tax is collected by hotels restaurants caterers and other businesses. 1350 per proof-gallon or 214 per 750ml 80-proof bottle.

Automate sales tax calculations reporting and filing today to save time and reduce errors. The state sales tax rate in New Hampshire is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. Join 16000 sales tax pros who get weekly sales tax tips.

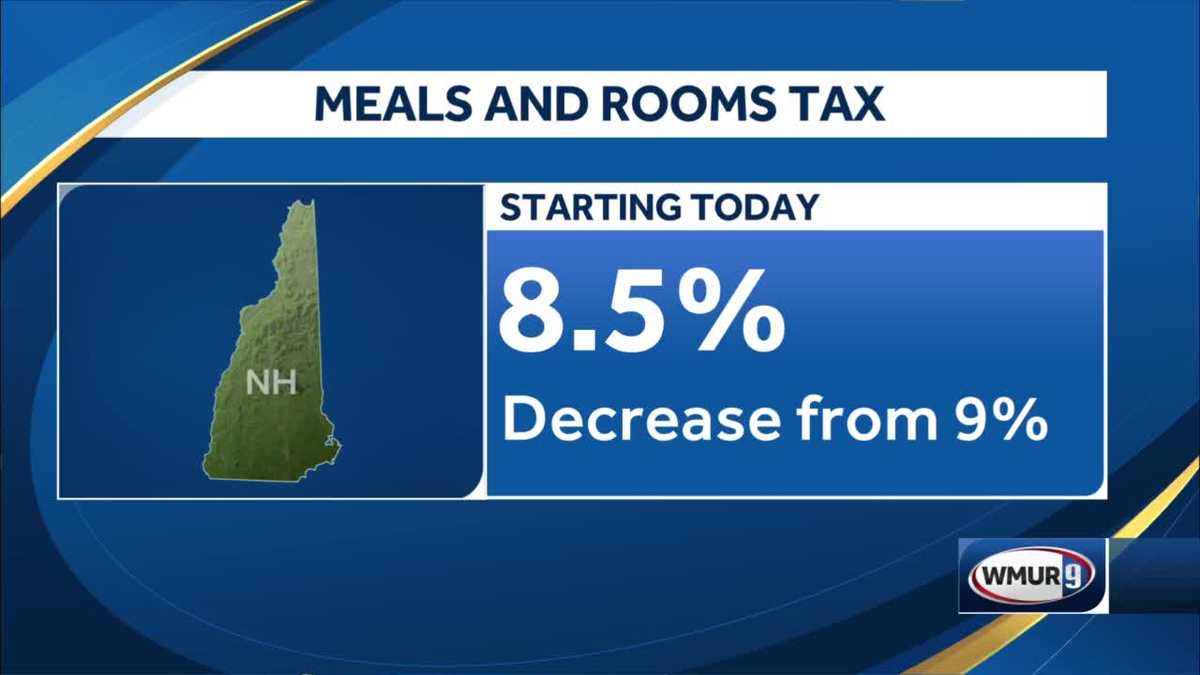

There are however several specific taxes levied on particular services or products. Start a trial Contact sales. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85.

There are no sales taxes on purchases made in the state. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Wayfair decision earlier this summer has stripped New Hampshire retailers of a key advantage in place for decades. New Hampshire Guidance on Food Taxability Released.

This is the Connecticut state sales tax rate plus and additional 1 sales tax. There are however several specific taxes levied on particular services or products. Whilst tourists save money on shopping because of the 0 sales tax on goods purchased in stores they will pay more for the services above.

NH Has No Sales Tax. A bit of that money goes toward school building loans and tourism promotion. Enriched flour Wheat flour niacin reduced iron thiamine mononitrate riboflavin and folic acid butter milk salt chocolate chips sugar chocolate liquor cocoa butter butterfat milk Soy lecithin as an emulsifier walnuts sugar eggs salt artificial.

Chocolate Chip Cookies batch 01-15. Select the New Hampshire city from the list of. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Tax Rate Starting Price. Technical Information Release TIR 2007-005 New Hampshire Department of Revenue Administration August 7 2007 Posted on August 22 2007. A proof gallon is a gallon of.

1800 per 31-gallon barrel or 005 per 12-oz can. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Fillable PDF Document Number.

New Hampshire is one of the few states with no statewide sales tax. Supreme Courts South Dakota v. If you need any assistance please contact us at 1-800-870-0285.

2021 New Hampshire state sales tax. Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on meals sold by eating establishments caterers or grocery stores is 735. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services. Federal excise tax rates on beer wine and liquor are as follows. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

They send the money to the state. The state sales tax rate in New Hampshire is 0000. There are no local taxes beyond the state rate.

Under this decision New Hampshire retailers are now subject to demands for customer information and tax payments from over 10000 separate taxing districts across the. A 9 tax is also assessed on motor vehicle rentals. Ashleys Cookies 2550 Kingston Lane Anytown NH 03333 603-555-5555.

While many other states allow counties and other localities to collect a local option sales tax New Hampshire does not permit local sales taxes to be collected. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

New Hampshire is a sales tax free state. New Hampshire is one of the few states without sales tax - the others being Delaware Montana and Oregon. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax.

107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. The Sales Tax Institute mailing list provides updates on the latest news tips. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals.

A 7 tax on phone services also exists in NH. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Exact tax amount may vary for different items.

Sales Taxes In The United States Wikiwand

New Hampshire Meals And Rooms Tax Rate Cut Begins

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

The Consumer S Guide To Sales Tax Taxjar Developers

New Hampshire Sales Tax Handbook 2022

States Without Sales Tax Article

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

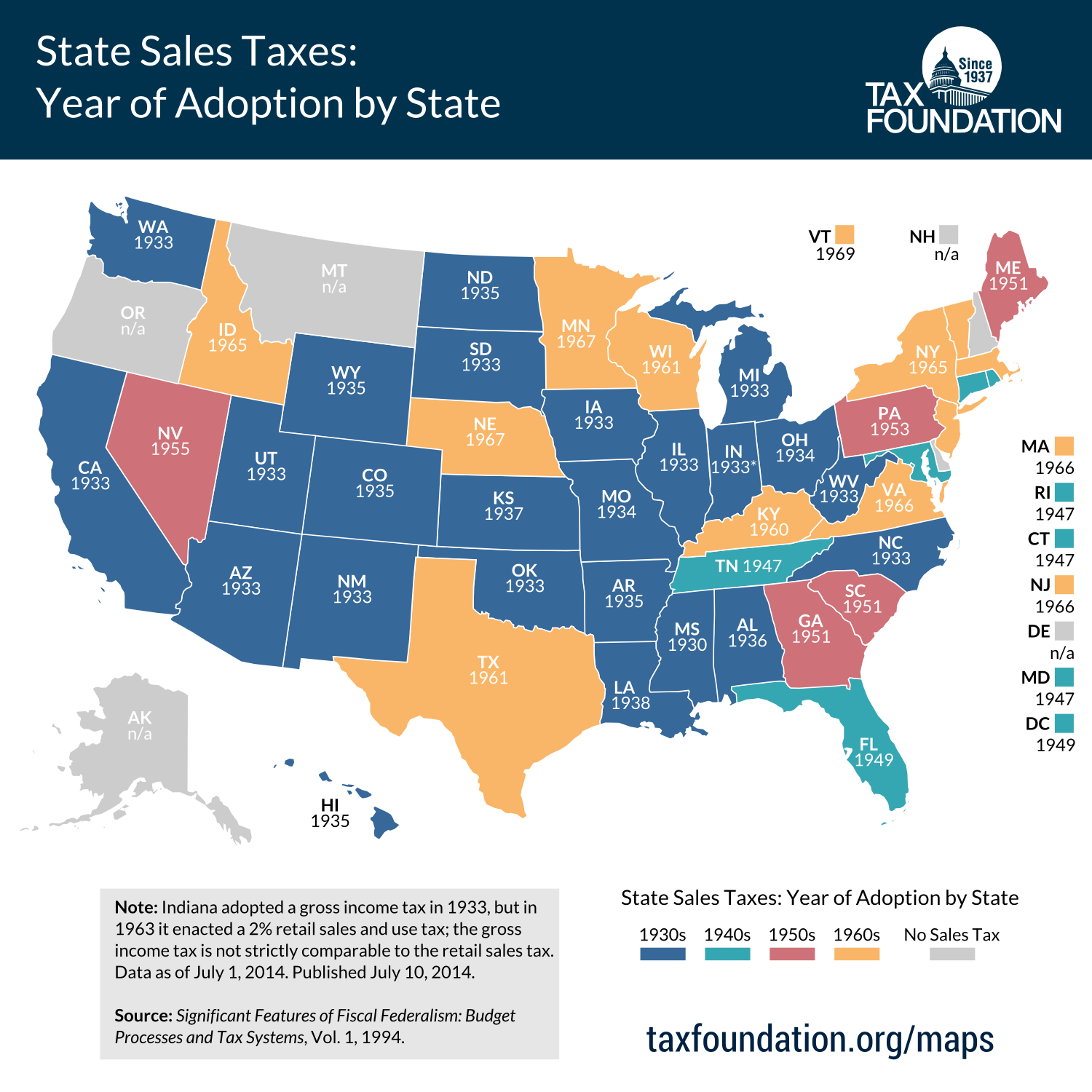

When Did Your State Adopt Its Sales Tax Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

U S States With No Sales Tax Taxjar

Sales Tax On Grocery Items Taxjar

States Without Sales Tax Article

New Hampshire Sales Tax Rate 2022

New Hampshire Sales Tax Rate 2022

States Without Sales Tax Article

Monday Map Sales Tax Exemptions For Groceries Tax Foundation