tax on forex trading in south africa

South African crypto tax consultants are of the opinion that since SARS has shared examples of capital gains tax disclosures only that this is the lay of the land. All expenses incurred from your forex trading must be deducted from the gross income of the trading to calculate the taxable profit from your forex trading.

Why Do Forex Prices Fluctuate Finance Advice Personal Finance Advice Money Management

Avatrade are particularly strong in integration including MT4.

. 4 years ago DTVTAuditors. Forex traders who are residing in South Africa are required to declare all their profits from forex trading on their annual tax returns. It is legal to trade Forex in South Africa as the South African Government doesnt have any laws governing the legality.

FXTM is a leading forex and CFD broker. 418 Translation of foreign taxes to rand and the determination of an exchange difference on a foreign tax debt. For this to be done you will also need a tax clearance.

I am trading in forex and would like to know whether I am subject to tax when I bring my earnings into the country. In the last years of the decade the market has experienced exceptional growth becoming comparable with leading Forex markets including the United Kingdom Canada Japan and even the US. The reason is that if you are seen as a tax resident this means that you will be taxed on all your income local and foreign.

Trading Forex in South Africa is legal as long as you declare your income tax and you abide by financial laws that prevent money laundering. Not only are there often accounting system limitations which in some cases only allow exchange rates to be updated on. Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns.

While the Forex market in this region is not a major trading hub like the four big trading sessions it is the major hub in Africa. A Fin24 user wants to know about tax relating to forex earnings. A real South African broker Banxso is headquartered in South Africa and.

Banxso is a relatively new Forex broker having come onto the scene after a well-publicized launch in 2022. Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns. In other words 60 of gains or losses are counted as long-term capital gains or losses and the remaining 40 is counted as short-term.

Forex Traders generally make two types of income commission income and direct FOREX trading gains and losses. As a result the profit that you make from trading forex meets the defection of gross income in the Income Tax Act and thus would be taxed as income based on the income tax tables for an individual. South Africa is no different and forex traders have to pay taxes on their profit.

Simply any profits made from currency trading in South Africa is subject to income tax with forex trading being classed as a gross income. Crypto Taxes in South Africa. Top 10 tips to pay less tax.

This is strongly advisable as otherwise there might be legal consequences. Forex Trading South Africa has a long-lasting and successful history starting from the 1980s. According to Keith Engel he is the CEO of the South African Institute of Tax Professionals SAIT he stated that a Forex Trader is taxed at normal rates of up to 45.

South African stocks suffer worst week since 2020. Offering a huge range of markets and 6 account types they cater to all levels of trader. The South African Reserve Bank control international monetary exchange overseeing outgoing cash-flow from the country 1Trading Forex is legal as long as you abide by financial laws that prevent money laundering 2 and you declare your.

Using FSCA regulated brokers is not a legal requirement but other recognized organizations should regulate the brokers used. Forex is legal in South Africa as long as it does not contravene money laundering laws and traders must declare any profits to SARS South African Revenue Service. South African businesses are exposed to foreign currency transactions on a daily basis which invariably cause practical issues around the appropriate foreign exchange rates to be used.

VAT and Forex. Shutterstock A Fin24 user trading in forex writes. However the tax system is very complicated and rules vary from case to case so it is impossible to give one unique solution about how much tax you are going to pay as a forex trader.

Therefore a point of great significance. According to the South African Revenue Service SARS Cryptocurrencies like Bitcoin are considered assets of an intangible nature. Before this is paid all expenses incurred should be deducted to determine the total taxable amount and as every South African resident is required to pay tax on international income forex traders must declare all their.

When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short-term capital gains rate. In South Africa however the top marginal personal income tax rate is 45 and top marginal capital gains tax rate is 18. Avoiding mistakes is key in learning any new craft.

If you want to learn more about Cryptocurrency in South Africa and if you should pay taxes on crypto trading read further below. 132 4181 Translation of foreign. Get a 30 Deposit Bonus - Get an extra 30 on top of your deposit thats up to 200 more to trade with.

455 in this category. This is in contrast to property or currency. Therefore local forex traders should keep all documents and records.

How To Avoid Tax Trading forex In South Africa For tax purposes forex options and futures contracts are considered IRC Section 1256 contracts which are subject to a 6040 tax consideration. While you do not have to use a regulated broker. The reason is that if you are seen as a tax resident this means that you will be taxed on all your income local and foreign.

Forex trading which is done through a registered South African company is subject to a flat tax rate of 28 of its taxable income.

Forex Trading In South Africa Complete Beginner S Guide 2022

How Do Forex Traders Pay Taxes Must Watch Youtube

We Have The Following Servicesforex Trading Strategy Trainingbinary Option Strategy Training Forex Training Option Strategies Forex Trading Training

What Time Does The Forex Market Open On Sunday In South Africa Forex Brokers Trading Forex

How To Make Tax Free Investment In South Africa Moneytoday Tax Free Investments Investing Tax Free

The Register Is A Company Registration Consultant That Can Assist You To Register Your Company In South Africa A Bee Certificate Income Tax Return Tax Services

Fxgm Za New Broker Review Trading Brokers Online Trading Brokers

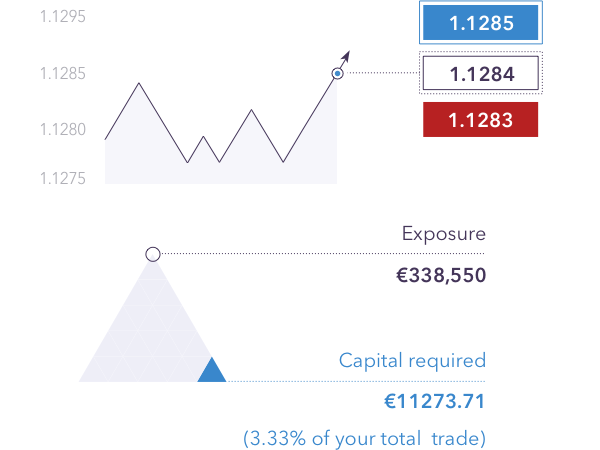

How To Trade Forex Forex Trading Examples Ig South Africa Ig South Africa

Central Banks And Their Role In The Currencies Exchange Central Bank Central Exchange Rate

Fast And Easy Way To Make Wealth On The Foreign Exchange Market You Have Always Easy Trading Charts Trade Finance Finance Investing

Forex Trading In South Africa For Beginners Updated 2022

Forex Digital Vega Strategy Forex Trend Trading Forex System

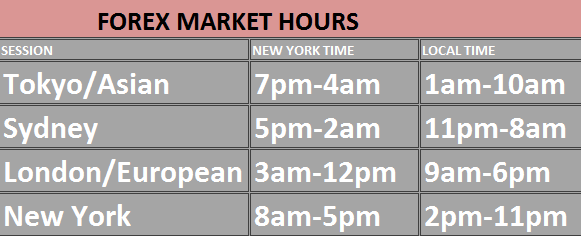

What Are Trading Sessions In South Africa Wheon

List Of Successful Forex Traders In South Africa

Forex Trading Sessions And Best Times To Trade Forex Trading Trading Forex

Your Forex Trading Career In South African Can Scale Higher Than Everbefore With The Right Broke Forex Trading Forex Trading Strategies Forex Trading Training